Commodity Futures Products

Explore available commodity futures contracts

Commodity futures provide direct exposure to physical goods through standardized contracts without the complexities of storing, transporting, or handling actual commodities. These contracts represent agreements to buy or sell specific quantities of raw materials at predetermined prices and dates, offering both commercial hedgers and speculators access to global commodity markets.

The global commodity derivatives market records a nominal trading volume that exceeds $140 trillion annually, reflecting the vast notional value transacted across major exchanges worldwide. Commodity futures serve as critical price discovery and risk management tools, benefiting industries such as agriculture, energy production, and manufacturing by providing transparent markets for hedging and investment.

Energy Futures: Oil, Natural Gas & Refined Products

Crude Oil: Global Benchmark Contracts

West Texas Intermediate (CL) - NYMEX:

-

Contract Size: 1,000 barrels per contract

-

Quality Standard: Light, sweet crude oil (37° API gravity, ≤0.42% sulfur)

-

Delivery Location: Cushing, Oklahoma — the central U.S. crude pipeline hub

-

Market Leadership: World’s most liquid energy futures contract, with daily volumes often exceeding 1 million contracts

-

Price Drivers: Influenced by OPEC policy, U.S. inventory data, global supply/demand, and geopolitical developments

Brent Crude Oil (BZ) - ICE:

-

Contract Size: 1,000 barrels per contract

-

Global Benchmark: Brent prices roughly 60% of the world’s crude oil supply

-

Brent–WTI Spread: Brent frequently trades at a premium to WTI, though the difference varies over time and can range from less than $1 to more than $10 per barrel

-

Market Focus: Primary pricing benchmark for Europe, Africa, and Asia; widely used in global seaborne crude markets

Micro WTI Crude (MCL):

- Contract Size: 100 barrels (1/10th of standard contract)

- Accessibility: Lower margin requirements (~$100)

- Ideal For: Individual traders, portfolio diversification, position testing

Natural Gas: Seasonal Volatility Leader

-

Contract Size (NG): 10,000 MMBtu per contract

-

Delivery Point: Henry Hub, Louisiana — key U.S. natural gas pipeline hub

-

Volatility: Natural gas is among the most volatile commodities, with annual price swings often exceeding 50%

-

Seasonality: Demand peaks in winter (heating) and summer (cooling) cycles

-

Key Market Movers: Weekly EIA storage reports, weather patterns, and U.S. energy production trends

-

E-mini Natural Gas (QG): 2,500 MMBtu (1/4 size of NG contract) with lower margins, though much less liquid than the standard contract

Metals Futures: Inflation Hedges and Economic Indicators

Precious Metals: Safe Haven Assets

Gold (GC) – COMEX:

-

Contract Size: 100 troy ounces

-

Quality Standard: .995 minimum fineness, approved refiner bars

-

Market Role: Safe haven during financial market stress, often inversely correlated with the U.S. dollar

-

Price Catalysts: Inflation expectations, currency devaluation, geopolitical uncertainty

-

Micro Gold (MGC): 10 troy ounces (1/10th of a standard contract) with lower margin requirements for smaller trading accounts

Silver (SI) – COMEX:

-

Contract Size: 5,000 troy ounces

-

Dual Nature: Functions as both a precious metal and an industrial commodity

-

Volatility: Typically 1.5–2x more volatile than gold

-

Industrial Demand: Electronics, solar panels, medical applications, batteries

Industrial Metals: Economic Barometers

Copper (HG) – COMEX:

-

Contract Size: 25,000 pounds

-

Economic Indicator: “Dr. Copper” is considered a barometer of global economic health

-

Demand Drivers: Construction, electrical infrastructure, renewable energy

-

China Factor: Chinese demand represents roughly 50% of global consumption

For detailed margin requirements across metals contracts, see our Understanding Futures Margins guide.

Corn (ZC) – CBOT:

-

Contract Size: 5,000 bushels

-

Primary Applications: Primarily animal feed and ethanol, with a smaller share used in food products

-

Weather Sensitivity: Midwest U.S. drought and flood conditions strongly influence pricing

-

Energy Connection: Crude oil prices affect corn demand for ethanol production

Soybeans (ZS) – CBOT:

-

Contract Size: 5,000 bushels

-

Value Chain: Crushed into soybean meal (animal feed) and soybean oil

-

Trade Dynamics: Chinese import demand is the largest factor in global soybean prices

-

Seasonal Competition: Brazilian harvest pressures supply during the U.S. off-season

Wheat (ZW) – CBOT:

-

Contract Size: 5,000 bushels

-

Global Varieties: Multiple wheat classes (hard red winter, soft red winter, spring wheat) traded across exchanges

-

Food Security: Critical global staple with strong ties to geopolitical stability

Soft Commodities: Tropical and Specialty Crops

Coffee (KC) – ICE:

-

Contract Size: 37,500 pounds (150 bags)

-

Quality Focus: Arabica coffee, considered higher quality than Robusta

-

Geographic Risk: Brazil produces about one-third of global supply; highly vulnerable to frost and drought

Sugar #11 (SB) – ICE:

-

Contract Size: 112,000 pounds (50 long tons)

-

Global Benchmark: Primary world reference price for raw sugar

-

Brazil Dominance: Brazil’s allocation between sugar and ethanol production significantly shapes supply

Livestock Futures: Protein Production

Live Cattle (LE) and Lean Hogs (HE) – CME:

-

Contract Size: 40,000 pounds each

-

Production Cycles: Hogs ~6 months vs. cattle ~18–24 months, affecting supply responsiveness

-

Feed Relationship: Corn and soybean meal costs directly influence production economics

-

Disease Risk: Health issues such as ASF in hogs or BSE in cattle can cause major supply shocks

Learn about agricultural contract specifications in our Futures Contract Specifications guide.

Market Participants and Commercial Hedging Applications

Commercial Hedgers: Risk Management Focus

Energy Sector Applications:

- Oil Companies: Hedge production against price declines

- Airlines: Lock in fuel costs for operational expense management

- Utilities: Hedge natural gas and electricity price volatility

- Refiners: Manage crack spreads between crude oil and refined products

Agricultural Hedging Strategies:

- Farmers: Hedge crop prices before and after harvest

- Food Processors: Lock in raw material costs for production planning

- Livestock Producers: Hedge feed costs and finished product prices

Metals Industry Risk Management:

- Mining Companies: Hedge production output against price declines

- Manufacturers: Lock in raw material costs for budget certainty

- Construction Companies: Hedge copper and steel input costs

Speculative Participants: Price Discovery and Liquidity

Individual Trader Applications:

- Day Trading: Short-term volatility and price movement strategies

- Swing Trading: Multi-day to multi-week position holding with Swing Trading Fundamentals

- Portfolio Diversification: Commodity exposure for inflation hedging

- Speculation: Directional bets on supply/demand imbalances

Key Trading Characteristics and Market Dynamics

Seasonality and Cyclical Patterns

Agricultural Seasonality:

- Spring Planting: Weather affects crop acreage and price expectations

- Summer Growing: Weather conditions drive yield forecasts and volatility

- Fall Harvest: Actual production confirms or revises supply estimates

Energy Seasonality:

- Summer Driving Season: Gasoline demand peaks May-September

- Winter Heating Season: Natural gas and heating oil demand surges

- Refinery Maintenance: Spring/fall turnaround seasons affect refined products

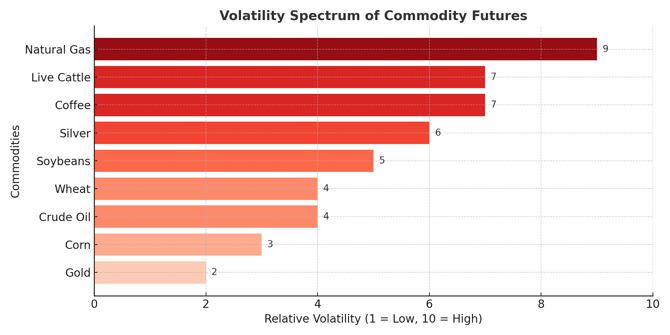

Volatility Characteristics and Risk Management

High Volatility Commodities:

- Natural Gas: Weather-driven demand creates extreme price swings

- Coffee: Weather and disease affect concentrated production regions

- Silver: Smaller market size amplifies price movements

Lower Volatility Commodities:

- Gold: Large, liquid market with diverse participant base

- Corn: Large global production and consumption base

- Crude Oil: Deep, liquid market with multiple stabilization mechanisms

Learn about position sizing across volatile commodity sectors in our Position Sizing Principles guide.

Technology and Market Access

Optimus Futures Commodity Access Advantages

With Optimus Futures, traders get comprehensive commodity market access:

Global Coverage: Access to 15+ commodity exchanges worldwide through a single account, including CME Group, ICE, and international markets.

Competitive Margins: Day trading margins as low as $300 for Micro Futures contracts compared to $3,000-6,000 for full-size contracts.

Advanced Platforms: Optimus Flow Desktop and TradingView integration for commodity analysis with real-time Level 2 market data included.

Extended Hours: Nearly 24-hour electronic trading access across global commodity markets.

Research and Analysis Tools:

- Fundamental data integration (weather, inventory, production data)

- Advanced charting with commodity-specific indicators

- Seasonal pattern analysis tools

- Inter-commodity and calendar spread trading capabilities

Frequently Asked Questions

What is the difference between commodity futures and commodity ETFs?

Commodity futures are direct contracts for physical delivery with precise exposure and leverage, while ETFs typically hold futures contracts or track commodity indices. Futures offer exact commodity exposure but require more active management, while ETFs provide easier access but may have tracking errors and management fees.

Which commodity futures are best for beginners?

Micro contracts like Micro WTI Crude (MCL) and Micro Gold (MGC) offer smaller position sizes and lower margin requirements. E-mini Natural Gas also provides manageable energy market exposure with capital requirements under $1,000.

How do weather conditions affect agricultural futures?

Weather impacts crop yields during critical growing seasons, directly affecting supply expectations. Drought conditions reduce yields and increase prices, while ideal weather can lead to bumper crops and lower prices. Agricultural markets are most weather-sensitive during May-August for U.S. crop development.

What drives crude oil futures prices?

Supply factors: OPEC production decisions, U.S. shale production, geopolitical disruptions. Demand factors: Global economic growth, transportation fuel consumption, industrial activity. Inventory data: Weekly EIA petroleum status reports showing supply/demand balance changes.

Can I take physical delivery of commodity futures?

Yes, most commodity futures allow physical delivery, but over 95% of contracts are closed before expiration. Physical delivery requires special account approval, storage arrangements, transportation logistics, and substantial additional costs beyond the contract value. Learn more in our Futures Delivery and Settlement Process guide.

How do commodity futures help hedge inflation?

Commodities often rise with inflation as raw material costs increase throughout the economy. Gold provides currency debasement protection, energy costs flow through to consumer prices, and agricultural products represent food inflation directly, making commodities natural inflation hedges.

How do micro commodity contracts work?

Micro contracts are fractional sizes of standard contracts (typically 1/10th size) with proportional margin requirements and identical price movements. They allow precise position sizing and lower capital requirements while maintaining full commodity price exposure.

What are the main risks in commodity futures trading?

Weather risk (agricultural), geopolitical risk (energy), currency risk (dollar-denominated pricing), storage cost changes, leverage risk (amplified gains and losses), and liquidity risk during certain periods. Learn comprehensive risk management in our Understanding Futures Risk guide.

Next Steps in Your Futures Education

Master the Fundamentals:

- ✅ Commodity products overview (covered in this article)

- Contract mechanics → Futures Contract Specifications

- Risk management → Understanding Futures Risk

Apply Your Knowledge:

- Market selection → Stock Index Futures

- Position sizing → Position Sizing Principles

- Order execution → Understanding Market Orders

Develop Trading Skills:

- Day Trading Fundamentals for short-term commodity strategies

- Swing Trading Fundamentals for multi-day commodity positions

- Volatility Trading Strategies for commodity volatility plays

Risk Disclaimer

The content of this guide is the opinion of Optimus Futures.

Futures and options trading involves substantial risk and is not suitable for all investors. Past performance is not necessarily indicative of future results. Examples provided are for illustrative and educational purposes only and should not be construed as specific trading advice or recommendations.

Trading on margin and with leverage carries a high level of risk, as it can amplify both gains and losses.

The placement of contingent orders such as "stop-loss" or "stop-limit" orders will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Risk management techniques discussed (such as stops, stop-limits, or bracket orders) cannot eliminate risk.

You should only trade with risk capital—that is, money you can afford to lose without affecting your lifestyle or financial security. There are no “proven” methods or guaranteed systems for making money in futures trading. It is a challenging process that requires ongoing learning, discipline, and adapting to changing market conditions. Traders must carefully consider their financial condition, risk tolerance, and trading objectives before engaging in futures or leveraged markets. It is important to note that most traders do lose money trading futures.