Understanding Level 1 Market Data

Understanding basic market data feeds

Your essential window into real-time futures markets for effective trading decisions.

Every futures trader starts here: Level 1 data. It's the basic information feed that shows you what's happening right now with very little guesswork or delay. While more advanced traders eventually graduate to Level 2 market data for deeper insights, Level 1 remains the foundation that powers most trading decisions and chart-based strategies.

Level 1 data is your market dashboard—providing the essential metrics you need to monitor price action, execute trades, and manage positions effectively. Whether you're using Optimus Flow Desktop, Optimus Web, or mobile apps, understanding this data is crucial for successful futures trading.

What Are Level 1 Market Data?

Key Definition: Level 1 market data provides real-time basic market information including the best bid and ask prices, last traded price, volume, and daily price statistics. It represents the "top of book" information that most traders use for price discovery and trade execution.

Here's what Level 1 typically gives you:

- Last traded price: The most recent deal executed

- Best bid: Top price buyers are offering

- Best ask: Lowest price sellers are willing to take

- Daily volume: How many contracts have traded

- Price change: Up or down compared to yesterday's close

- High/low prices: Today's range so far

- Opening price: Where the session kicked off

- Previous close: Where the last session ended

Simple? Yes. But it's absolutely essential for trading futures successfully. This data forms the backbone of price charts and provides the real-time information needed for most day trading strategies and position management.

Important: Level 1 data updates in real-time during market hours, making it critical for timing entries and exits in fast-moving markets.

How Does Level 1 Market Data Work?

Level 1 data streams directly from futures exchanges, providing a continuous feed of the most important price and volume information. Unlike delayed data, Level 1 gives you the current market state as orders execute and bid-ask spreads fluctuate.

Real-Time Price Discovery

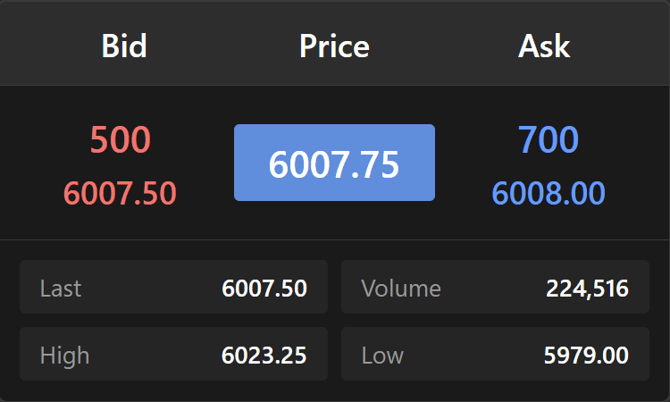

E-mini S&P 500 Example:

- Last: 6007.75

- Bid: 6007.50 (buyers willing to pay)

- Ask: 6008.00 (sellers willing to accept)

- Volume: 224,516

This snapshot tells you the market is slightly bullish (trading above the bid), has good liquidity based on volume, and shows modest positive momentum for the session. Clealry, this is just one signal and not indicative of immediate direction.

Market Timing Applications

Level 1 data helps you identify:

- Entry points: When bid/ask alignment suggests direction

- Exit signals: When price approaches daily highs/lows

- Market gaps: Comparing current price to previous close

- Volume confirmation: High volume supporting price moves

Risk Warning: Level 1 data shows only the surface of market depth. Large orders can quickly move prices beyond visible bid/ask levels.

What Makes Level 1 Market Data Unique?

Exchange Integration

Level 1 data comes directly from futures exchanges like CME, providing authoritative pricing without the fragmentation seen in stock markets. Each futures contract has one primary exchange, ensuring consistent and reliable data feeds.

Real-Time Execution Foundation

Unlike end-of-day data or delayed feeds, Level 1 provides the live information needed for:

- Market order execution: Knowing current bid/ask for instant fills

- Limit order placement: Setting realistic price targets

- Stop-loss management: Monitoring current price relative to stop levels

Chart Construction

Level 1 data feeds the price charts that most traders rely on for technical analysis. Every candlestick, bar, and line chart derives from this fundamental data stream.

Key Advantage: Level 1 gives you the same core information that institutions see, creating a level playing field for market access.

Who Uses Level 1 Market Data?

Chart-Based Traders

Most futures traders using technical analysis rely primarily on Level 1 data. If you trade using price action, indicators, or pattern recognition, Level 1 provides everything needed for effective decision-making.

Trading Applications:

- Swing trading: Daily highs/lows for entry/exit planning

- Trend following: Price change and momentum indicators

- Breakout strategies: Monitoring price relative to key levels

Position Traders

Longer-term traders use Level 1 data for:

- Entry timing: Getting better fills on position entries

- Portfolio monitoring: Tracking unrealized P&L

- Risk management: Setting and adjusting stop-loss orders

Retail Futures Traders

Individual traders find Level 1 data sufficient for most strategies because:

- Lower complexity: Easier to interpret than deeper market data

- Cost effective: Often included free with basic trading platforms

- Proven effectiveness: Works well for standard trading approaches

What Do Market Participants Need to Know?

Platform Configuration

Ensure your trading platform displays all essential Level 1 elements:

- Current bid/ask with sizes

- Last trade price and time

- Daily volume and change statistics

- Session high/low prices

Most platforms allow customization of data display. Configure alerts for significant price changes or volume spikes to stay informed during active trading periods.

Data Quality Considerations

Reliable Data Sources:

- Use direct exchange feeds when possible

- Verify data accuracy during volatile market conditions

- Monitor for delayed or stale data during system issues

Timing Optimization

Level 1 data is most valuable during:

- Regular trading hours: Peak liquidity and accurate pricing

- Economic announcements: Rapid price changes requiring real-time monitoring

- Contract roll periods: Transitioning between expiration months

Key Concepts for Level 1 Market Data

Bid-Ask Relationship

The relationship between bid and ask prices reveals market sentiment:

- Tight spreads: High liquidity and efficient pricing

- Wide spreads: Lower liquidity or volatile conditions

- Price at bid: Selling pressure dominance

- Price at ask: Buying pressure strength

Volume Validation

Daily volume confirms price move legitimacy:

- High volume + price move: Strong directional conviction

- Low volume + price move: Potentially temporary or weak trend

- Volume spikes: Often precede significant price changes

What You Can Do With Level 1 Data

Level 1 data is the heartbeat of basic trading. You'll use it to:

- Spot quick market moves during news events or gap openings

- Build reliable price charts for technical analysis

- Place and monitor trades with current market pricing

- Track open positions and unrealized P&L

- Stay on top of daily performance across multiple contracts

If you can read Level 1 confidently, you're already ahead of most beginners. It's essentially your launchpad into faster decisions and smarter analysis.

Frequently Asked Questions

Is Level 1 data sufficient for most futures trading strategies?

Yes, Level 1 data provides everything needed for chart-based trading strategies, swing trading, and position management. Most successful traders rely primarily on Level 1 data combined with technical analysis tools.

How does Level 1 data differ from Level 2 market data?

Level 1 shows only the best bid and ask prices, while Level 2 data reveals multiple price levels and order book depth. Level 1 is like seeing the tip of an iceberg, while Level 2 shows the full depth underneath.

Does Level 1 data update in real-time?

Yes, Level 1 data updates continuously during market hours as trades execute and orders change. This real-time information is essential for accurate market order execution and current position valuation.

Can I trade effectively using only Level 1 data?

Absolutely. Many professional traders use primarily Level 1 data for day trading and longer-term strategies. Level 1 provides the core price information needed for most technical analysis and risk management approaches.

How do I interpret bid-ask spreads in Level 1 data?

Bid-ask spreads show market liquidity and transaction costs. Tight spreads (1-2 ticks) indicate good liquidity, while wide spreads suggest lower liquidity or volatile conditions that may increase execution costs.

What platforms provide reliable Level 1 data for futures?

Professional platforms like Optimus Flow Desktop and Optimus Web provide reliable real-time Level 1 data directly from futures exchanges. Important: Ensure your data feed includes real-time rather than delayed information.

Should beginners start with Level 1 or Level 2 data?

Beginners should master Level 1 data first. It provides all essential information for learning basic trading concepts and developing effective strategies. Level 2 data becomes valuable later for advanced order flow analysis techniques.

Why do some traders insist on Level 1 instead of Level 2 data?

Not all traders need the extra detail of Level 2 market depth. Many rely on Level 1 data—best bid, best ask, last trade, and volume—because it provides all the essential information required for price discovery and order execution. Level 1 is also less expensive than Level 2 subscriptions, and for strategies like swing trading or longer-term analysis, additional depth of market data doesn’t necessarily add value. For these traders, Level 1 offers a cost-effective, streamlined view of the market.

Does CME charge different prices for Level 1 and Level 2 data?

Yes. The CME charges different fees for Level 1 and Level 2 market data. Level 1 data (top-of-book: best bid, best ask, last trade, and daily statistics) is priced lower, while Level 2 data (depth-of-market with multiple bid/ask levels) carries higher subscription costs. Traders who only need basic price discovery often choose Level 1 to save on fees, while active day traders and scalpers may pay extra for Level 2 to see market depth..

Next Steps in Your Futures Education

Master the Fundamentals:

- ✅ Level 1 market data overview (covered in this article)

- Advanced data → Level 2 Market Depth Explained

- Order types → Understanding Market Orders

Apply Your Knowledge:

- Execution skills → Understanding Limit Orders

- Cost management → Understanding Bid-Ask Spreads

- Risk control → Understanding Stop and Stop-Limit Orders

Develop Trading Skills:

- Day Trading Fundamentals for Level 1 data applications

- Position Management Techniques for trade monitoring

- Market Positioning and Technical Analysis for chart interpretation

Risk Disclaimer

The content of this guide is the opinion of Optimus Futures.

Futures and options trading involves substantial risk and is not suitable for all investors. Past performance is not necessarily indicative of future results. Examples provided are for illustrative and educational purposes only and should not be construed as specific trading advice or recommendations.

Trading on margin and with leverage carries a high level of risk, as it can amplify both gains and losses.

The placement of contingent orders such as "stop-loss" or "stop-limit" orders will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Risk management techniques discussed (such as stops, stop-limits, or bracket orders) cannot eliminate risk.

You should only trade with risk capital—that is, money you can afford to lose without affecting your lifestyle or financial security. There are no “proven” methods or guaranteed systems for making money in futures trading. It is a challenging process that requires ongoing learning, discipline, and adapting to changing market conditions. Traders must carefully consider their financial condition, risk tolerance, and trading objectives before engaging in futures or leveraged markets. It is important to note that most traders do lose money trading futures.